Finance: US banks in turmoil over hidden assets

0

0

In their crusade against money laundering and other financial crimes, the United States is scrutinizing the nooks and crannies of financial giants such as Bank of America, JPMorgan Chase, and Citibank. Recently, their balance sheets revealed concerning irregularities, putting the Biden administration on high alert.

American Finance: Billions in Assets Hidden by Banks

These financial behemoths, although not engaged in the frenzy of Bitcoin ETFs, maintain a marked interest in the world of cryptocurrency. By conducting investigations and analyses, or even issuing their own crypto-assets, they attract the attention of authorities, opening a new chapter in American financial regulation.

Billions of dollars, tucked away in the shadows, escape the balance sheets of America’s financial giants. According to recent disclosures from the United States government, JPMorgan Chase, Bank of America, and Citibank are closely guarding unknown and potentially risky assets, out of the public eye.

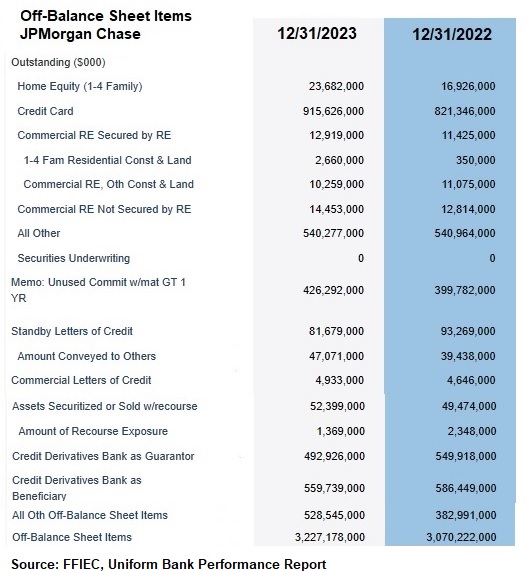

The figures, emerging from the depths of the Federal Financial Institutions Examination Council (FFIEC) and reported by Wall Street on Parade, are dizzying: JPMorgan Chase is said to hold $3.227 trillion off-balance sheet, while Bank of America and Citibank purportedly house respectively 1.6 and 2.6 trillion.

The Federal Reserve describes these off-balance sheet activities as “highly diverse,” encompassing a range of financial instruments, from loan agreements to options and derivative contracts. A common practice, indeed, but not without recalling the excesses that led to the 2008 financial crisis.

Citigroup, in particular, stands out with mountains of off-balance sheet assets, widely used to manipulate capital requirements. But history remembers that in 2008, Citigroup collapsed, calling for aid during the largest bailouts in global banking history.

Banks Angry Over Stricter Capital Requirements

Last July, the Federal Reserve proposed stricter capital fund rules for banks, aiming to strengthen their balance sheets against potential economic downturns. However, CEOs of the largest American banks, including JPMorgan Chase, Wells Fargo, and Bank of America, expressed their opposition during a Senate hearing in December.

Jamie Dimon, an anti-bitcoin (BTC) proponent leading JPMorgan Chase, warned that these changes could harm the economy by limiting banks’ capacity to invest at crucial times. According to him, the requirements proposed by the Basel III Endgame rule would unjustifiably increase capital constraints by 20 to 25% for large banks, with negative repercussions on American markets and households.

A struggle between banking interests and global financial security is at play.

0

0